Fed Policy Success Equals Tax Payers Job Insecurity October 11th, 2023

The low level of work stoppages of recent years also attests to concern about job security.

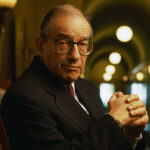

Testimony of Chairman Alan Greenspan

The Federal Reserve’s semiannual monetary policy report

Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

February 26, 1997

Iappreciate the opportunity to appear before this Committee to present the Federal Reserve’s semiannual report on monetary policy.

The performance of the U.S. economy over the past year has been quite favorable. Real GDP growth picked up to more than three percent over the four quarters of 1996, as the economy progressed through its sixth year of expansion. Employers added more than two-and-a-half million workers to their payrolls in 1996, and the unemployment rate fell further. Nominal wages and salaries have increased faster than prices, meaning workers have gained ground in real terms, reflecting the benefits of rising productivity. Outside the food and energy sectors, increases in consumer prices actually have continued to edge lower, with core CPI inflation only 2-1/2 percent over the past twelve months.

Low inflation last year was both a symptom and a cause of the good economy. It was symptomatic of the balance and solidity of the expansion and the evident absence of major strains on resources. At the same time, continued low levels of inflation and inflation expectations have been a key support for healthy economic performance. They have helped to create a financial and economic environment conducive to strong capital spending and longer-range planning generally, and so to sustained economic expansion. Consequently, the Federal Open Market Committee (FOMC) believes it is crucial to keep inflation contained in the near term and ultimately to move toward price stability.

Looking ahead, the members of the FOMC expect inflation to remain low and the economy to grow appreciably further. However, as I shall be discussing, the unusually good inflation performance of recent years seems to owe in large part to some temporary factors, of uncertain longevity. Thus, the FOMC continues to see the distribution of inflation risks skewed to the upside and must remain especially alert to the possible emergence of imbalances in financial and product markets that ultimately could endanger the maintenance of the low-inflation environment. Sustainable economic expansion for 1997 and beyond depends on it.

For some, the benign inflation outcome of 1996 might be considered surprising, as resource utilization rates–particularly of labor–were in the neighborhood of those that historically have been associated with building inflation pressures. To be sure, an acceleration in nominal labor compensation, especially its wage component, became evident over the past year. But the rate of pay increase still was markedly less than historical relationships with labor market conditions would have predicted. Atypical restraint on compensation increases has been evident for a few years now and appears to be mainly the consequence of greater worker insecurity. In 1991, at the bottom of the recession, a survey of workers at large firms by International Survey Research Corporation indicated that 25 percent feared being laid off. In 1996, despite the sharply lower unemployment rate and the tighter labor market, the same survey organization found that 46 percent were fearful of a job layoff.

The reluctance of workers to leave their jobs to seek other employment as the labor market tightened has provided further evidence of such concern, as has the tendency toward longer labor union contracts. For many decades, contracts rarely exceeded three years. Today, one can point to five- and six-year contracts–contracts that are commonly characterized by an emphasis on job security and that involve only modest wage increases. The low level of work stoppages of recent years also attests to concern about job security.

Thus, the willingness of workers in recent years to trade off smaller increases in wages for greater job security seems to be reasonably well documented. The unanswered question is why this insecurity persisted even as the labor market, by all objective measures, tightened considerably. One possibility may lie in the rapid evolution of technologies in use in the work place. Technological change almost surely has been an important impetus behind corporate restructuring and downsizing. Also, it contributes to the concern of workers that their job skills may become inadequate. No longer can one expect to obtain all of one’s lifetime job skills with a high-school or college diploma. Indeed, continuing education is perceived to be increasingly necessary to retain a job. The more pressing need to update job skills is doubtless also a factor in the marked expansion of on- the-job training programs, especially in technical areas, in many of the nation’s corporations.

Certainly, other factors have contributed to the softness in compensation growth in the past few years. The sharp deceleration in health care costs, of course, is cited frequently. Another is the heightened pressure on firms and their workers in industries that compete internationally. Domestic deregulation has had similar effects on the intensity of competitive forces in some industries. In any event, although I do not doubt that all these factors are relevant, I would be surprised if they were nearly as important as job insecurity.

If heightened job insecurity is the most significant explanation of the break with the past in recent years, then it is important to recognize that, as I indicated in last February’s Humphrey-Hawkins testimony, suppressed wage cost growth as a consequence of job insecurity can be carried only so far. At some point, the tradeoff of subdued wage growth for job security has to come to an end. In other words, the relatively modest wage gains we have experienced are a temporary rather than a lasting phenomenon because there is a limit to the value of additional job security people are willing to acquire in exchange for lesser increases in living standards. Even if real wages were to remain permanently on a lower upward track than otherwise as a result of the greater sense of insecurity, the rate of change of wages would revert at some point to a normal relationship with inflation. The unknown is when this transition period will end.

Indeed, some recent evidence suggests that the labor markets bear especially careful watching for signs that the return to more normal patterns may be in process. The Bureau of Labor Statistics reports that people were somewhat more willing to quit their jobs to seek other employment in January than previously. The possibility that this reflects greater confidence by workers accords with a recent further rise in the percent of households responding to a Conference Board survey who perceive that job availability is plentiful. Of course, the job market has continued to be quite good recently; employment in January registered robust growth and initial claims for unemployment insurance have been at a relatively low level of late. Wages rose faster in 1996 than in 1995 by most measures, perhaps also raising questions about whether the transitional period of unusually slow wage gains may be drawing to a close.

To be sure, the pickup in wage gains has not shown through to underlying price inflation. Increases in the core CPI, as well as in several broader measures of prices, have stayed subdued or even edged off further in recent months. As best we can judge, faster productivity growth last year meant that rising compensation gains did not cause labor costs per unit of output to increase any more rapidly. Non-labor costs, which are roughly a quarter of total consolidated costs of the nonfinancial corporate sector, were little changed in 1996.

Owing in part to this subdued behavior of unit costs, profits and rates of return on capital have risen to high levels. As a consequence, businesses believe that, were they to raise prices to boost profits further, competitors with already ample profit margins would not follow suit; instead, they would use the occasion to capture a greater market share. This interplay is doubtless a significant factor in the evident loss of pricing power in American business.

Intensifying global competition also may be further restraining domestic firms’ ability to hike prices as well as wages. Clearly, the appreciation of the dollar on balance over the past eighteen months or so, together with low inflation in many of our trading partners, has resulted in a marked decline in non-oil import prices that has helped to damp domestic inflation pressures. Yet it is important to emphasize that these influences, too, would be holding down inflation only temporarily; they represent a transition to a lower price level than would otherwise prevail, not to a permanently lower rate of inflation.

Against the background of all these considerations, the FOMC has recognized the need to remain vigilant for signs of potentially inflationary imbalances that might, if not corrected promptly, undermine our economic expansion. The FOMC in fact has signaled a state of heightened alert for possible policy tightening since last July in its policy directives. But, we have also taken care not to act prematurely. The FOMC refrained from changing policy last summer, despite expectations of a near-term policy firming by many financial market participants. In light of the developments I’ve just discussed affecting wages and prices, we thought inflation might well remain damped, and in any case was unlikely to pick up very rapidly, in part because the economic expansion appeared likely to slow to a more sustainable pace. In the event, inflation has remained quiescent since then.

Given the lags with which monetary policy affects the economy, however, we cannot rule out a situation in which a preemptive policy tightening may become appropriate before any sign of actual higher inflation becomes evident. If the FOMC were to implement such an action, it would be judging that the risks to the economic expansion of waiting longer had increased unduly and had begun to outweigh the advantages of waiting for uncertainties to be reduced by the accumulation of more information about economic trends. Indeed, the hallmark of a successful policy to foster sustainable economic growth is that inflation does not rise. I find it ironic that our actions in 1994-95 were criticized by some because inflation did not turn upward. That outcome, of course, was the intent of the tightening, and I am satisfied that our actions then were both necessary and effective, and helped to foster the continued economic expansion.

To be sure, 1997 is not 1994. The real federal funds rate today is significantly higher than it was three years ago. Then we had just completed an extended period of monetary ease which addressed the credit stringencies of the early 1990s, and with the abatement of the credit crunch, the low real funds rate of early 1994 was clearly incompatible with containing inflation and sustaining growth going forward. In February 1997, in contrast, our concern is a matter of relative risks rather than of expected outcomes. The real funds rate, judging by core inflation, is only slightly below its early 1995 peak for this cycle and might be at a level that will promote continued non- inflationary growth, especially considering the recent rise in the exchange value of the dollar. Nonetheless, we cannot be sure. And the risks of being wrong are clearly tilted to the upside.

I wish it were possible to lay out in advance exactly what conditions have to prevail to portend a buildup of inflation pressures or inflationary psychology. However, the circumstances that have been associated with increasing inflation in the past have not followed a single pattern. The processes have differed from cycle to cycle, and what may have been a useful leading indicator in one instance has given off misleading signals in another.

I have already discussed the key role of labor market developments in restraining inflation in the current cycle and our careful monitoring of signs that the transition phase of trading off lower real wages for greater job security might be coming to a close. As always, with resource utilization rates high, we would need to watch closely a situation in which demand was clearly unsustainable because it was producing escalating pressures on resources, which could destabilize the economy. And we would need to be watchful that the progress we have made in keeping inflation expectations damped was not eroding. In general, though, our analysis will need to encompass all potentially relevant information, from financial markets as well as the economy, especially when some signals, like those in the labor market, have not been following their established patterns.

The ongoing economic expansion to date has reinforced our conviction about the importance of low inflation–and the public’s confidence in continued low inflation. The economic expansion almost surely would not have lasted nearly so long had monetary policy supported an unsustainable acceleration of spending that induced a buildup of inflationary imbalances. The Federal Reserve must not acquiesce in an upcreep in inflation, for acceding to higher inflation would countenance an insidious weakening of our chances for sustaining long-run economic growth. Inflation interferes with the efficient allocation of resources by confusing price signals, undercutting a focus on the longer run, and distorting incentives.

This year overall inflation is anticipated to stay restrained. The central tendency of the forecasts made by the Board members and Reserve Bank presidents has the increase in the total CPI slipping back into a range of 2-3/4 to 3 percent over the four quarters of the year. This slight falloff from last year’s pace is expected to owe in part to a slower rise in food prices as some of last year’s supply limitations ease. More importantly, world oil supplies are projected by most analysts to increase relative to world oil demand, and futures markets project a further decline in prices, at least in the near term. The recent and prospective declines in crude oil prices not only should affect retail gasoline and home heating oil prices but also should relieve inflation pressures through lower prices for other petroleum products, which are imbedded in the economy’s underlying cost structure. Nonetheless, the trend in inflation rates in the core CPI and in broader price measures may be somewhat less favorable than in recent years. A continued tight labor market, whose influence on costs would be augmented by the scheduled increase in the minimum wage later in the year and perhaps by higher growth of benefits now that considerable health-care savings already have been realized, could put upward pressure on core inflation. Moreover, the effects of the sharp rise in the dollar over the last eighteen months in pushing down import prices are likely to ebb over coming quarters.

The unemployment rate, according to Board members and Bank presidents, should stay around 5-1/4 to 5-1/2 percent through the fourth quarter, consistent with their projections of measured real GDP growth of 2 to 2-1/4 percent over the four quarters of the year. Such a growth rate would represent some downshifting in output expansion from that of last year. The projected moderation of growth likely would reflect several influences: (1) declines in real federal government purchases should be exerting a modest degree of restraint on overall demand; (2) the lagged effects of the increase in the exchange value of the dollar in recent months likely will damp U.S. net exports somewhat this year; and (3) residential construction is unlikely to repeat the gains of 1996. On the other hand, we do not see evidence of widespread imbalances either in business inventories or in stocks of equipment and consumer durables that would lead to a substantial cutback in spending. And financial conditions overall remain supportive; real interest rates are not high by historical standards and credit is readily available from intermediaries and in the market.

The usual uncertainties in the overall outlook are especially focused on the behavior of consumers. Consumption should rise roughly in line with the projected moderate expansion of disposable income, but both upside and downside risks are present. According to various surveys, sentiment is decidedly upbeat. Consumers have enjoyed healthy gains in their real incomes along with the extraordinary stock-market driven rise in their financial wealth over the last couple of years. Indeed, econometric models suggest that the more than $4 trillion rise in equity values since late 1994 should have had a larger positive influence on consumer spending than seems to have actually occurred.

It is possible, however, that households have been reluctant to spend much of their added wealth because they see a greater need to keep it to support spending in retirement. Many households have expressed heightened concern about their financial security in old age, which reportedly has led to increased provision for retirement. The results of a survey conducted annually by the Roper Organization, which asks individuals about their confidence in the Social Security system, shows that between 1992 and 1996 the percent of respondents expressing little or no confidence in the system jumped from about 45 percent to more than 60 percent.

Moreover, consumer debt burdens are near historical highs, while credit card delinquencies and personal bankruptcies have risen sharply over the past year. These circumstances may make both borrowers and lenders a bit more cautious, damping spending. In fact, we may be seeing both wealth and debt effects already at work for different segments of the population, to an approximately offsetting extent. Saving out of current income by households in the upper income quintile, who own nearly three-fourths of all non-pension equities held by households, evidently has declined in recent years. At the same time, the use of credit for purchases appears to have leveled off after a sharp runup from 1993 to 1996, perhaps because some households are becoming debt constrained and, as a result, are curtailing their spending.

The Federal Reserve will be weighing these influences as it endeavors to help extend the current period of sustained growth. Participants in financial markets seem to believe that in the current benign environment the FOMC will succeed indefinitely. There is no evidence, however, that the business cycle has been repealed. Another recession will doubtless occur some day owing to circumstances that could not be, or at least were not, perceived by policymakers and financial market participants alike. History demonstrates that participants in financial markets are susceptible to waves of optimism, which can in turn foster a general process of asset-price inflation that can feed through into markets for goods and services. Excessive optimism sows the seeds of its own reversal in the form of imbalances that tend to grow over time. When unwarranted expectations ultimately are not realized, the unwinding of these financial excesses can act to amplify a downturn in economic activity, much as they can amplify the upswing. As you know, last December I put the question this way: “…how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions …?”

We have not been able, as yet, to provide a satisfying answer to this question, but there are reasons in the current environment to keep this question on the table. Clearly, when people are exposed to long periods of relative economic tranquility, they seem inevitably prone to complacency about the future. This is understandable. We have had fifteen years of economic expansion interrupted by only one recession–and that was six years ago. As the memory of such past events fades, it naturally seems ever less sensible to keep up one’s guard against an adverse event in the future. Thus, it should come as no surprise that, after such a long period of balanced expansion, risk premiums for advancing funds to businesses in virtually all financial markets have declined to near- record lows.

Is it possible that there is something fundamentally new about this current period that would warrant such complacency? Yes, it is possible. Markets may have become more efficient, competition is more global, and information technology has doubtless enhanced the stability of business operations. But, regrettably, history is strewn with visions of such “new eras” that, in the end, have proven to be a mirage. In short, history counsels caution.

Such caution seems especially warranted with regard to the sharp rise in equity prices during the past two years. These gains have obviously raised questions of sustainability. Analytically, current stock-price valuations at prevailing long-term interest rates could be justified by very strong earnings growth expectations. In fact, the long-term earnings projections of financial analysts have been marked up noticeably over the last year and seem to imply very high earnings growth and continued rising profit margins, at a time when such margins are already up appreciably from their depressed levels of five years ago. It could be argued that, although margins are the highest in a generation, they are still below those that prevailed in the 1960s. Nonetheless, further increases in these margins would evidently require continued restraint on costs: labor compensation continuing to grow at its current pace and productivity growth picking up. Neither, of course, can be ruled out. But we should keep in mind that, at these relatively low long-term interest rates, small changes in long-term earnings expectations could have outsized impacts on equity prices.

Caution also seems warranted by the narrow yield spreads that suggest perceptions of low risk, possibly unrealistically low risk. Considerable optimism about the ability of businesses to sustain this current healthy financial condition seems, as I indicated earlier, to be influencing the setting of risk premiums, not just in the stock market but throughout the financial system. This optimistic attitude has become especially evident in quality spreads on high- yield corporate bonds–what we used to call “junk bonds.” In addition, banks have continued to ease terms and standards on business loans, and margins on many of these loans are now quite thin. Many banks are pulling back a little from consumer credit card lending as losses exceed expectations. Nonetheless, some bank and nonbank lenders have been expanding aggressively into the home equity loan market and so-called “subprime” auto lending, although recent problems in the latter may already be introducing a sense of caution.

Why should the central bank be concerned about the possibility that financial markets may be overestimating returns or mispricing risk? It is not that we have a firm view that equity prices are necessarily excessive right now or risk spreads patently too low. Our goal is to contribute as best we can to the highest possible growth of income and wealth over time, and we would be pleased if the favorable economic environment projected in markets actually comes to pass. Rather, the FOMC has to be sensitive to indications of even slowly building imbalances, whatever their source, that, by fostering the emergence of inflation pressures, would ultimately threaten healthy economic expansion.

Unfortunately, because the monetary aggregates were subject to an episode of aberrant behavioral patterns in the early 1990s, they are likely to be of only limited help in making this judgment. For three decades starting in the early 1960s, the public’s demand for the broader monetary aggregates, especially M2, was reasonably predictable. In the intermediate term, M2 velocity–nominal income divided by the stock of M2–tended to vary directly with the difference between money market yields and the return on M2 assets–that is, with its short-term opportunity cost. In the long run, as adjustments in deposit rates caused the opportunity cost to revert to an equilibrium, M2 velocity also tended to return to an associated stable equilibrium level. For several years in the early 1990s, however, the velocities of M2 and M3 exhibited persisting upward shifts that departed markedly from these historical patterns.

In the last two to three years, velocity patterns seem to have returned to those historical relationships, after allowing for a presumed permanent upward shift in the levels of velocity. Even so, given the abnormal velocity behavior during the early 1990s, FOMC members continue to see considerable uncertainty in the relationship of broad money to opportunity costs and nominal income. Concern about the possibility of aberrant behavior has made the FOMC hesitant to upgrade the role of these measures in monetary policy.

Against this background, at its February meeting, the FOMC reaffirmed the provisional ranges set last July for money and debt growth this year: 1 to 5 percent for M2, 2 to 6 percent for M3, and 3 to 7 percent for the debt of domestic nonfinancial sectors. The M2 and M3 ranges again are designed to be consistent with the FOMC’s long-run goal of price stability: For, if the velocities of the broader monetary aggregates were to continue behaving as they did before 1990, then money growth around the middle portions of the ranges would be consistent with noninflationary, sustainable economic expansion. But, even with such velocity behavior this year, when inflation is expected to still be higher than is consistent with our long-run objective of reasonable price stability, the broader aggregates could well grow around the upper bounds of these ranges. The debt aggregate probably will expand around the middle of its range this year.

I will conclude on the same upbeat note about the U.S. economy with which I began. Although a central banker’s occupational responsibility is to stay on the lookout for trouble, even I must admit that our economic prospects in general are quite favorable. The flexibility of our market system and the vibrancy of our private sector remain examples for the whole world to emulate. The Federal Reserve will endeavor to do its part by continuing to foster a monetary framework under which our citizens can prosper to the fullest possible extent.

Home

Top of Pg.

|

Home Top of Pg. Read more →

Foie gras with Sauternes, Photo by Laurent Espitallier As an Appetizer Pale dry Sherry, with or without bitters, chilled or not. Plain or mixed Vermouth, with or without bitters. A dry cocktail. With Oysters, Clams or Caviar A dry flinty wine such as Chablis, Moselle, Champagne. Home Top of [...] Read more →

Man looks at severed hand and foot….for refusing to climb a tree to cut rubber for King Leopold Click here to read The Crime of the Congo by Arthur Conan Doyle Victim of King Leopold of Belgium Click on the link below for faster download. The [...] Read more →

Home Top of Pg. Read more →

Add 3 quarts clover blossoms* to 4 quarts of boiling water removed from heat at point of boil. Let stand for three days. At the end of the third day, drain the juice into another container leaving the blossoms. Add three quarts of fresh water and the peel of one lemon to the blossoms [...] Read more →

The following research discussion is from a study funded by the U.S. National Institute of Health entitled: Boschniakia rossica prevents the carbon tetrachloride-induced hepatotoxicity in rat. It may be of interest to heavy drinkers. Home Top of [...] Read more →

Home Top of Pg. Read more →

Fred Kummerow on statin drugs (excerpt) from Jeremy Stuart on Vimeo. Dr. Kummerow passed away at the ripe old age of 102 in 2017. Click here to visit Dr. Mercola’s website. Home Top of Pg. Read more →

From A History of Fowling, Being an Account of the Many Curios Devices by Which Wild Birds are, or Have Been, Captured in Different Parts of the World by Rev. H.A. MacPherson, M.A. THE RAVEN (Corvus corax) is generally accredited with a large endowment of mother wit. Its warning [...] Read more →

Reprint from the Sportsman Cabinet and Town & Country Magazine, Vol.1, Number 1, November 1832. MR. Editor, Will you allow me to inquire, through the medium of your pages, the correct meaning of the term thorough-bred fox-hound? I am very well aware, that the expression is in common [...] Read more →

Home Top of Pg. Read more →

Blackbeard’s Jolly Roger If you’re looking for that most refreshing of summertime beverages for sipping out on the back patio or perhaps as a last drink before walking the plank, let me recommend my Blunderbuss Mai Tai. I picked up the basics to this recipe over thirty years ago when holed up [...] Read more →

Photo by Rebecca Humann Texas Tea Recipe 2 oz Cuervo Gold Tequila Home Top of [...] Read more →

Cleaner for Gilt Frames. Calcium hypochlorite…………..7 oz. Sodium bicarbonate……………7 oz. Sodium chloride………………. 2 oz. Distilled water…………………12 oz. Home Top of Pg. Read more →

BOOKS CONDEMNED TO BE BURNT. By JAMES ANSON FARRER, LONDON ELLIOT STOCK, 62, PATERNOSTER ROW 1892 ———- WHEN did books first come to be burnt in England by the common hangman, and what was [...] Read more →

Home Top of Pg. Read more →

A Real Soda Jerk FORMULAS FROM VARIOUS SOURCES. Pineapple Frappe. Water, 1 gallon; sugar 2 pounds of water. 61/2 pints, and simple syrup. 2 1/2 pints; 2 pints of pineapple stock or 1 pint of pineapple stock and 1 pint of grated pineapple juice of 6 lemons. Mix, [...] Read more →

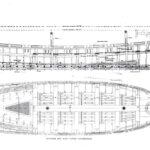

Dec. 24, 1898 Forest and Stream Pg. 513-514 The Standard Navy Boats. Above we find, The accompanying illustrations show further details of the standard navy boats, the lines of which appeared last week. In all of these boats, as stated previously, the quality of speed has been given [...] Read more →

Note on Watercolour: F.A. Molony (fl. 1930-1938) was a Major in the Royal Engineers. The National Army Museum hold his work. His work was also shown at an exhibition of officers work at the R.B.A. Galleries (Army Officers’ Art Society) Description from Youtube: June 2015 will see [...] Read more →

Click here to view a copy of Arban’s Complete Conservatory Method for Cornet Click on the blue button to download a free copy of Arban’s Complete Conservatory Method for Cornet Arban's - 11.8MB For trumpet players wishing to practice daily using an iPad, simply click [...] Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

Crewe Hall Dining Room THE transient tenure that most of us have in our dwellings, and the absorbing nature of the struggle that most of us have to make to win the necessary provisions of life, prevent our encouraging the manufacture of well-wrought furniture. We mean to outgrow [...] Read more →

Home Top of Pg. Read more →

Linseed oil is readily available in many oil painters’ studios. Yardley London Shea Butter Soap can be purchased from a dollar store or pound shop on the cheap. These two ingredients make for the basis of an excellent cleaning system for cleaning oil painting brushes. Home Top of [...] Read more →

Dominion, Royal St. Lawrence Yacht Club,Winner of Seawanhaka Cup, 1898. The Tail Wags the Dog. The following is a characteristic sample of those broad and liberal views on yachting which are the pride of the Boston Herald. Speaking of the coming races for the Seawanhaka international challenge cup, it says: [...] Read more →

If ever it could be said that there is such a thing as miracle healing soil, Ivan Sanderson said it best in his 1965 book entitled Ivan Sanderson’s Book of Great Jungles. Sanderson grew up with a natural inclination towards adventure and learning. He hailed from Scotland but spent much [...] Read more →

PEACH BRANDY 2 gallons + 3 quarts boiled water 3 qts. peaches, extremely ripe 3 lemons, cut into sections 2 sm. pkgs. yeast 10 lbs. sugar 4 lbs. dark raisins Place peaches, lemons and sugar in crock. Dissolve yeast in water (must NOT be to hot). Stir thoroughly. Stir daily for 7 days. Keep [...] Read more →

Chipping a Turpentine Tree DISTILLING TURPENTINE One of the Most Important Industries of the State of Georgia Injuring the Magnificent Trees Spirits, Resin, Tar, Pitch, and Crude Turpentine all from the Long Leaved Pine – “Naval Stores” So Called. Dublin, Ga., May 8. – One of the most important industries [...] Read more →

Hunters at Work This is a recipe I created from scratch by trial and error. (Note: This recipe contains no eggs, refined white flour or white sugar.) 2 Cups Whole Wheat Flour – As unprocessed as you can find it 3 Cups of Raw Oatmeal 1 Cup of [...] Read more →

Home Top of Pg. Read more →

Looking to spice up your dinner? Let’s hop along and cook some roo. Home Top of Pg. Read more →

The following highly collectible Franklin Library Signed Editions were published between 1977 and 1982. They are all fully leather bound with beautiful covers and contain gorgeous and rich silk moire endpapers. Signatures are protected by unattached tissue inserts. The values listed are average prices that were sought by [...] Read more →

Eadweard Muybridge was a fascinating character. Click here to learn how Eadweard committed “Justifiable Homicide” after shooting his wife’s lover in 1874. Home Top of Pg. Read more →

The arsenicals (compounds which contain the heavy metal element arsenic, As) have a long history of use in man – with both benevolent and malevolent intent. The name ‘arsenic’ is derived from the Greek word ‘arsenikon’ which means ‘potent'”. As early as 2000 BC, arsenic trioxide, obtained from smelting copper, was used [...] Read more →

Wojna Kalmarska – 1611 The Kalmar War From The Historian’s History of the World (In 25 Volumes) by Henry Smith William L.L.D. – Vol. XVI.(Scandinavia) Pg. 308-310 The northern part of the Scandinavian peninsula, as already noticed, had been peopled from the remotest times by nomadic tribes called Finns or Cwenas by [...] Read more →

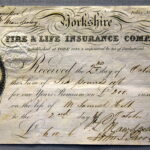

Life insurance certificate issued by the Yorkshire Fire & Life Insurance Company to Samuel Holt, Liverpool, England, 1851. On display at the British Museum in London. Donated by the ifs School of Finance. Photo by Osama Shukir Muhammed Amin FRCP(Glasg) From How to Make Money; and How to Keep it, Or, Capital and Labor [...] Read more →

The low level of work stoppages of recent years also attests to concern about job security. Testimony of Chairman Alan Greenspan The Federal Reserve’s semiannual monetary policy report Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate February 26, 1997 Iappreciate the opportunity to appear before this Committee [...] Read more →

Officers and men of the 13th Light Dragoons, British Army, Crimea. Rostrum photograph of photographer’s original print, uncropped and without color correction. Survivors of the Charge. Half a league, half a league, Half a league onward, All in the valley of Death Rode the six hundred. “Forward, the Light Brigade! Charge for the [...] Read more →

Edwin Austin Abbey. King Lear, Act I, Scene I (Cordelia’s Farewell) The Metropolitan Museum of Art. Dates: 1897-1898 Dimensions: Height: 137.8 cm (54.25 in.), Width: 323.2 cm (127.24 in.) Medium: Painting – oil on canvas Home Top of Pg. Read more →

Dutch artist Herman de Vries – Photo taken by son Vince The two videos below of Herman de Vries at work at the Venice Bienalle 2015 are quite inspiring. So inspiring in fact that I moved into a cave for two weeks and wrote Shakespearean tragedy with charcoal. Filled with great joy [...] Read more →

CLAIRVOYANCE by C. W. Leadbeater Adyar, Madras, India: Theosophical Pub. House [1899] CHAPTER IX – METHODS OF DEVELOPMENT When a men becomes convinced of the reality of the valuable power of clairvoyance, his first question usually is, “How can [...] Read more →

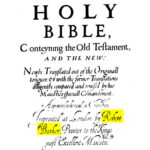

Richard Barker KJ Title Pg. Robert Barker was the printer of the first edition of the King James Bible in 1611. He was the printer to King James I and son of Christopher Barker, printer to Queen Victoria I. Home Top of Pg. Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

. Home Top of [...] Read more →

KING ARTHUR AND HIS KNIGHTS On the decline of the Roman power, about five centuries after Christ, the countries of Northern Europe were left almost destitute of a national government. Numerous chiefs, more or less powerful, held local sway, as far as each could enforce his dominion, and occasionally those [...] Read more →

THE FIRST step in producing a satisfactory crop of tobacco is to use good seed that is true to type. The grower often can save his own seed to advantage, if he wants to. Before topping is done, he should go over the tobacco field carefully to pick [...] Read more →

Stoke Park Pavillions Stoke Park Pavilions, UK, view from A405 Road. photo by Wikipedia user Cj1340 From Wikipedia: Stoke Park – the original house Stoke park was the first English country house to display a Palladian plan: a central house with balancing pavilions linked by colonnades or [...] Read more →

The downloadable audio clip is of FDR’s Second Fireside Chat recorded on May 7th, 1933. FDR 2nd Fireside Chat - May 7, 1933 - 18.5MB The transcript that follows is my corrected version of the transcript that is found The American Presidency Project website that was created [...] Read more →

Any prudent investor would jump at the chance to receive a guaranteed 6% dividend for life. So how does one get in on this action? The fact of the matter is…YOU can’t…That is unless you are a shareholder of one of the twelve Federal Reserve Banks and the banks under [...] Read more →

Click here to visit Lil’ Lost Lou and purchase a copy of her latest album. Home Top of Pg. Read more →

THE FOWLING PIECE, from the Shooter’s Guide by B. Thomas – 1811. I AM perfectly aware that a large volume might be written on this subject; but, as my intention is to give only such information and instruction as is necessary for the sportsman, I shall forbear introducing any extraneous [...] Read more →

Home Top of Pg. Read more →

From Allen’s Indian Mail, December 3rd, 1851 BOMBAY. MUSULMAN FANATICISM. On the evening of November 15th, the little village of Mahim was the scene of a murder, perhaps the most determined which has ever stained the annals of Bombay. Three men were massacred in cold blood, in a house used [...] Read more →

The Apex Building, headquarters of the Federal Trade Commission, on Constitution Avenue and 7th Streets in Washington, D.C.. The building was designed by Edward H. Bennett under the purview of Secretary of the Treasury Andrew W. Mellon, and was completed in 1938 at a cost of $125 million. Photo by Carol M. Highsmith [...] Read more →

Reprint from The Pitfalls of Speculation by Thomas Gibson 1906 Ed. THE PUBLIC ATTITUDE TOWARD SPECULATION THE public attitude toward speculation is generally hostile. Even those who venture frequently are prone to speak discouragingly of speculative possibilities, and to point warningly to the fact that an overwhelming majority [...] Read more →

Home Top of Pg. Read more →

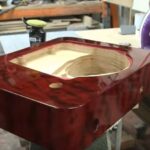

San Felipe Model Reprinted from FineModelShips.com with the kind permission of Dr. Michael Czytko The SAN FELIPE is one of the most favoured ships among the ship model builders. The model is elegant, very beautifully designed, and makes a decorative piece of art to be displayed at home or in the [...] Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

To learn more about Julian McDonnell, film director, click here. Home Top of Pg. Read more →

DECORATED or “sumptuous” furniture is not merely furniture that is expensive to buy, but that which has been elaborated with much thought, knowledge, and skill. Such furniture cannot be cheap, certainly, but the real cost of it is sometimes borne by the artist who produces rather than by the man who may [...] Read more →

Book Conservators, Mitchell Building, State Library of New South Wales, 29.10.1943, Pix Magazine The following is taken verbatim from a document that appeared several years ago in the Maine State Archives. It seems to have been removed from their website. I happened to have made a physical copy of it at the [...] Read more →

A rhetorical question? Genuine concern? In this essay we are examining another form of matter otherwise known as national literary matters, the three most important of which being the Matter of Rome, Matter of France, and the Matter of England. Our focus shall be on the Matter of England or [...] Read more →

Video courtesy of Imperial War Museums, UK Home Top of Pg. Read more →

Home Top of [...] Read more →

Home Top of Pg. Read more →

July 9, 1898. Forest and Stream Pg. 25 Some Notes on American Ship-Worms. [Read before the American Fishes Congress at Tampa.] While we wish to preserve and protect most of the products of our waters, these creatures we would gladly obliterate from the realm of living things. For [...] Read more →

Over the years I have observed a decline in manners amongst young men as a general principle and though there is not one particular thing that may be asserted as the causal reason for this, one might speculate… Self-awareness and being aware of one’s surroundings in social interactions [...] Read more →

Click here to access the Internet Archive of old Popular Mechanics Magazines – 1902-2016 Click here to view old Popular Mechanics Magazine Covers Home Top of Pg. Read more →

? This video by AT Restoration is the best hands on video I have run across on the basics of classic upholstery. Watch a master at work. Simply amazing. Tools: Round needles: https://amzn.to/2S9IhrP Double pointed hand needle: https://amzn.to/3bDmWPp Hand tools: https://amzn.to/2Rytirc Staple gun (for beginner): https://amzn.to/2JZs3x1 Compressor [...] Read more →

Resolution adapted at the New Orleans Convention of the American Institute of Banking, October 9, 1919: “Ours is an educational association organized for the benefit of the banking fraternity of the country and within our membership may be found on an equal basis both employees and employers; [...] Read more →

Armorial tablet of the Stewarts – Falkland Palace Fife, Scotland. The Stewart Kings – King James I & VI to Charles II Six video playlist on the Kings of England: Home Top of Pg. Read more →

Jul. 23, 1898 Forest and Stream, Pg. 65 Horn Measurements. Editor Forest and Stream: “Record head.” How shamefully this term is being abused, especially in the past three years; or since the giant moose from Alaska made his appearance in public and placed all former records (so far as [...] Read more →

Gate of Honour, Caius Court, Gonville & Caius Gonville & Caius College, known as Caius and pronounced keys was founded in 1348 by Edmund Gonville, the Rector of Terrington St Clement in Norfolk. The first name was thus Goville Hall and it was dedicated to the Annunciation of the Blessed Virgin Mary. [...] Read more →

A CROCK OF SQUIRREL 4 young squirrels – quartered Salt & Pepper 1 large bunch of fresh coriander 2 large cloves of garlic 2 tbsp. salted sweet cream cow butter ¼ cup of brandy 1 tbsp. turbinado sugar 6 fresh apricots 4 strips of bacon 1 large package of Monterrey [...] Read more →

From Fores’s Sporting Notes and Sketches, A Quarterly Magazine Descriptive of British, Indian, Colonial, and Foreign Sport with Thirty Two Full Page Illustrations Volume 10 1893, London; Mssrs. Fores Piccadilly W. 1893, All Rights Reserved. GLIMPSES OF THE CHASE, Ireland a Hundred Years Ago. By ‘Triviator.’ FOX-HUNTING has, like Racing, [...] Read more →

Take the large blue figs when pretty ripe, and steep them in white wine, having made some slits in them, that they may swell and gather in the substance of the wine. Then slice some other figs and let them simmer over a fire in water until they are reduced [...] Read more →

It was a strange assignment. I picked up the telegram from desk and read it a third time. NEW YORK, N.Y., MAY 9, 1949 HAVE BEEN INVESTIGATING FLYING SAUCER MYSTERY. FIRST TIP HINTED GIGANTIC HOAX TO COVER UP OFFICIAL SECRET. BELIEVE IT MAY HAVE BEEN PLANTED TO HIDE [...] Read more →

Reprint from the Royal Collection Trust Website The meeting between Henry VIII and Francis I, known as the Field of the Cloth of Gold, took place between 7 to 24 June 1520 in a valley subsequently called the Val d’Or, near Guisnes to the south of Calais. The [...] Read more →

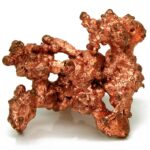

Are you considering purchasing a copper water pitcher for storing drinking water but have questions about the effects on your health? The following study may help jump-start your research. Storing Drinking-water in Copper pots Kills Contaminating Diarrhoeagenic Bacteria ABSTRACT Microbially-unsafe water is [...] Read more →

WIPO HQ Geneva UNITED STATES PLANT VARIETY PROTECTION ACT TITLE I – PLANT VARIETY PROTECTION OFFICE Chapter Section 1. Organization and Publications . 1 2. Legal Provisions as to the Plant Variety Protection Office . 21 3. Plant Variety Protection Fees . 31 CHAPTER 1.-ORGANIZATION AND PUBLICATIONS Section [...] Read more →

Click here to read the full text of the Hunting Act – 2004 Home Top of Pg. Read more →

Home Top of Pg. Read more →

Reprint from The Pitfalls of Speculation by Thomas Gibson 1906 Ed. THE PUBLIC ATTITUDE TOWARD SPECULATION THE public attitude toward speculation is generally hostile. Even those who venture frequently are prone to speak discouragingly of speculative possibilities, and to point warningly to the fact that an [...] Read more →

Guarea guidonia Recipe 5 Per Cent Alcohol 8-24 Grain – Heroin Hydrochloride 120 Minims – Tincture Euphorbia Pilulifera 120 Minims – Syrup Wild Lettuce 40 Minims – Tincture Cocillana 24 Minims – Syrup Squill Compound 8 Gram – Ca(s)ecarin (P, D, & Co.) 8-100 Grain Menthol Dose – One-half to one fluidrams (2 to [...] Read more →

Click here to access the world’s most powerful Import/Export Research Database on the Planet. With this search engine one is able to access U.S. Customs and other government data showing suppliers for any type of company in the United States. Home Top of Pg. Read more →

Sucker The components of any given market place include both physical structures set up to accommodate trading, and participants to include buyers, sellers, brokers, agents, barkers, pushers, auctioneers, agencies, and propaganda outlets, and banking or transaction exchange facilities. Markets are generally set up by sellers as it is in their [...] Read more →

Half a league, half a league, Half a league onward, All in the valley of Death Rode the six hundred. “Forward, the Light Brigade! Charge for the guns!” he said. Into the valley of Death Rode the six hundred. Home Top of [...] Read more →

Charles Dickens wrote much more than novels. In fact he turned out several very interesting dictionaries to include one of London, one of Paris and one on London’s long meandering river Thames. Click here to read a copy of the Dictionary of the Thames. Home Top of Pg. Read more →

Home Top of Pg. Read more →

The Queen Elizabeth Trust, or QEST, is an organisation dedicated to the promotion of British craftsmanship through the funding of scholarships and educational endeavours to include apprenticeships, trade schools, and traditional university classwork. The work of QEST is instrumental in keeping alive age old arts and crafts such as masonry, glassblowing, shoemaking, [...] Read more →

*note – Billesdon and Billesden have both been used to name the hunt. BILLESDEN COPLOW POEM [From “Reminiscences of the late Thomas Assheton Smith, Esq”] The run celebrated in the following verses took place on the 24th of February, 1800, when Mr. Meynell hunted Leicestershire, and has since been [...] Read more →

Home Top of Pg. Read more →

From The How and When, An Authoritative reference reference guide to the origin, use and classification of the world’s choicest vintages and spirits by Hyman Gale and Gerald F. Marco. The Marco name is of a Chicago family that were involved in all aspects of the liquor business and ran Marco’s Bar [...] Read more →

William Wyggeston’s chantry house, built around 1511, in Leicester: The building housed two priests, who served at a chantry chapel in the nearby St Mary de Castro church. It was sold as a private dwelling after the dissolution of the chantries. A Privately Built Chapel Chantry, chapel, generally within [...] Read more →

Hernando de Soto (c1496-1542) Spanish explorer and his men torturing natives of Florida in his determination to find gold. Hand-coloured engraving. John Judkyn Memorial Collection, Freshford Manor, Bath The print above depicts Spanish explorer Hernando de Soto and his band of conquistadors torturing Florida natives in order to extract information on where [...] Read more →

J.P. Morgan Patent #8,452,703 Method and system for processing internet payments using the electronic funds transfer network. Abstract Embodiments of the invention include a method and system for conducting financial transactions over a payment network. The method may include associating a payment address of an account [...] Read more →

WITCHCRAFT, SORCERY, MAGIC AND OTHER PSYCHOLOGICAL PHENOMENA AND THEIR IMPLICATIONS ON MILITARY AND PARAMILITARY OPERATIONS IN THE CONGO This report has been prepared in response to a query posed by ODCS/OPS, Department of the Army, regarding the purported use of witchcraft, sorcery, and magic by insurgent elements in the Republic [...] Read more →

Click here to read the Condon Report Home Top of Pg. Read more →

What is follows is an historical article that appeared in The Hartford Courant in 1916 about the arsenic murders carried out by Mrs. Archer-Gilligan. This story is the basis for the 1944 Hollywood film “Arsenic and Old Lace” starring Cary Grant and Priscilla Lane and directed by Frank Capra. The [...] Read more →

THE answer to the question, What is fortune has never been, and probably never will be, satisfactorily made. What may be a fortune for one bears but small proportion to the colossal possessions of another. The scores or hundreds of thousands admired and envied as a fortune in most of our communities [...] Read more →

To Choose Poultry. When fresh, the eyes should be clear and not sunken, the feet limp and pliable, stiff dry feet being a sure indication that the bird has not been recently killed; the flesh should be firm and thick and if the bird is plucked there should be no [...] Read more →

NAPOLEON’S PHARMACISTS. Of the making of books about Napoleon there is no end, and the centenary of his death (May 5) is not likely to pass without adding to the number, but a volume on Napoleon”s pharmacists still awaits treatment by the student in this field of historical research. There [...] Read more →

Country House Christmas Pudding Ingredients 1 cup Christian Bros Brandy ½ cup Myer’s Dark Rum ½ cup Jim Beam Whiskey 1 cup currants 1 cup sultana raisins 1 cup pitted prunes finely chopped 1 med. apple peeled and grated ½ cup chopped dried apricots ½ cup candied orange peel finely chopped 1 ¼ cup [...] Read more →

THE sense of a consecutive tradition has so completely faded out of English art that it has become difficult to realise the meaning of tradition, or the possibility of its ever again reviving; and this state of things is not improved by the fact that it is due to uncertainty of purpose, [...] Read more →

King Leopold Butcher of the Congo For the somewhat startling suggestion in the heading of this interview, the missionary interviewed is in no way responsible. The credit of it, or, if you like, the discredit, belongs entirely to the editor of the Review, who, without dogmatism, wishes to pose the question as [...] Read more →

From the classic British Movie, The Shooting Party, a 1985 British drama film directed by Alan Bridges based on Isabel Colegate’s 9th novel of the same name published in 1980 we find a scene set in the billiards parlor whereupon the host of the weekend shooting party Sir Randolph Nettleby walks in [...] Read more →

NEWSPAPER.-Printed sheets published at stated intervals, chiefly for the purpose of conveying intelligence on current events. The Romans wrote out an account of the most memorable occurrences of the day, which were sent to public officials. They were entitled Acta Durna, and read substantially like the local column of a [...] Read more →

Traditional British Christmas Pudding Recipe by Pen Vogler from the Charles Dickens Museum Ingredients 85 grams all purpose flour pinch of salt 170 grams Beef Suet 140 grams brown sugar tsp. mixed spice, allspice, cinnamon, cloves, &c 170 grams bread crumbs 170 grams raisins 170 grams currants 55 grams cut mixed peel Gram to [...] Read more →

The following cure was found written on a front flyleaf in an 1811 3rd Ed. copy of The Sportsman’s Guide or Sportsman’s Companion: Containing Every Possible Instruction for the Juvenille Shooter, Together with Information Necessary for the Experienced Sportsman by B. Thomas. Transcript: Vaccinate your dogs when young [...] Read more →

Add the following ingredients to a four or six quart crock pot, salt & pepper to taste keeping in mind that salt pork is just that, cover with water and cook on high till it boils, then cut back to low for four or five hours. A slow cooker works well, I [...] Read more →

Click here to visit the New Yorkshire YouTube channel. Home Top of Pg. Read more →

Baking is a very similar process to roasting: the two often do duty for one another. As in all other methods of cookery, the surrounding air may be several degrees hotter than boiling water, but the food is no appreciably hotter until it has lost water by evaporation, after which it may [...] Read more →

Home Top of Pg. Read more →

Noel Desenfans and Sir Francis Bourgeois, circa 1805 by Paul Sandby, watercolour on paper The Dulwich Picture Gallery was England’s first purpose-built art gallery and considered by some to be England’s first national gallery. Founded by the bequest of Sir Peter Francis Bourgois, dandy, the gallery was built to display his vast [...] Read more →

Muscadine Jelly 6 cups muscadine grape juice 6 cups sugar 1 box Kraft Sure Gel or Ball Fruit Jell Home Top of [...] Read more →

Home Top of Pg. Read more →

Dried Norwegian Salt Cod Fried fish cakes are sold rather widely in delicatessens and at prepared food counters of department stores in the Atlantic coastal area. This product has possibilities for other sections of the country. Ingredients: Home Top of [...] Read more →

Silverfish damage to book – photo by Micha L. Rieser The beauty of hunting silverfish is that they are not the most clever of creatures in the insect kingdom. Simply take a small clean glass jar and wrap it in masking tape. The masking tape gives the silverfish something to [...] Read more →

Cannone nel castello di Haut-Koenigsbourg, photo by Gita Colmar Without any preliminary cleaning the bronze object to be treated is hung as cathode into the 2 per cent. caustic soda solution and a low amperage direct current is applied. The object is suspended with soft copper wires and is completely immersed into [...] Read more →

Dr. David Starkey, the UK’s premiere historian, speaks to the modern and fleeting notion of “cancel culture”. Starkey’s brilliance is unparalleled and it has become quite obvious to the world’s remaining Western scholars willing to stand on intellectual integrity that a few so-called “Woke Intellectuals” most certainly cannot undermine [...] Read more →

Mortlake Tapestries at Chatsworth House Click here to read copy of Daemonologie Home Top of Pg. Read more →

German made shotguns by Krieghoff, founded in 1886. Home Top of Pg. Read more →

Chen Lin, Water fowl, in Cahill, James. Ge jiang shan se (Hills Beyond a River: Chinese Painting of the Yuan Dynasty, 1279-1368, Taiwan edition). Taipei: Shitou chubanshe fen youxian gongsi, 1994. pl. 4:13, p. 180. Collection of the National Palace Museum, Taipei. scroll, light colors on paper, 35.7 x 47.5 cm Read more →

? The Band: Miles Davis (trumpet), Wayne Shorter (sax), Herbie Hancock (piano), Ron Carter (bass), Tony Williams (drums) Home Top of Pg. Read more →

Modern slow cookers come in all sizes and colors with various bells and whistles, including timers and shut off mechanisms. They also come with a serious design flaw, that being the lack of a proper domed lid. The first photo below depict a popular model Crock-Pot® sold far and wide [...] Read more →

Full Cover, rear, spine, and front Published by Piranesi Press in collaboration with Country House Essays, this beautiful paperback version of the King James Bible is now available for $79.95 at Barnes and Noble.com This is a limited Edition of 500 copies Worldwide. Click here to view other classic books [...] Read more →

Reprint from The Sportsman’s Cabinet and Town and Country Magazine, Vol I. Dec. 1832, Pg. 94-95 To the Editor of the Cabinet. SIR, Possessing that anxious feeling so common among shooters on the near approach of the 12th of August, I honestly confess I was not able [...] Read more →

Furniture Polishing Cream. Animal oil soap…………………….1 onuce Solution of potassium hydroxide…. .5 ounces Beeswax……………………………1 pound Oil of turpentine…………………..3 pints Water, enough to make……………..5 pints Dissolve the soap in the lye with the aid of heat; add this solution all at once to the warm solution of the wax in the oil. Beat [...] Read more →

” Here’s many a year to you ! Sportsmen who’ve ridden life straight. Here’s all good cheer to you ! Luck to you early and late. Here’s to the best of you ! You with the blood and the nerve. Here’s to the rest of you ! What of a weak moment’s swerve ? [...] Read more →

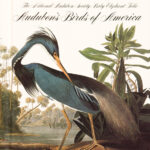

Audubon started to develop a special technique for drawing birds in 1806 a Mill Grove, Pennsylvania. He perfected it during the long river trip from Cincinnati to New Orleans and in New Orleans, 1821. Home Top of [...] Read more →

July, 16, l898 Forest and Stream Pg. 48 Tuna and Tarpon. New York, July 1.—Editor Forest and Stream: If any angler still denies the justice of my claim, as made in my article in your issue of July 2, that “the tuna is the grandest game [...] Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

Early Texas photo of Tarpon catch – Not necessarily the one mentioned below… July 2, 1898. Forest and Stream Pg.10 Texas Tarpon. Tarpon, Texas.—Mr. W. B. Leach, of Palestine, Texas, caught at Aransas Pass Islet, on June 14, the largest tarpon on record here taken with rod and reel. The [...] Read more →

Donate to the YouTube site owner Gabe and he might send you some chocolate…. Home Top of Pg. Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

From Dr. Marvel’s 1929 book entitled Hoodoo for the Common Man, we find his infamous Hoochie Coochie Hex. What follows is a verbatim transcription of the text: The Hoochie Coochie Hex should not be used in conjunction with any other Hexes. This can lead to [...] Read more →

Home Top of Pg. Read more →

Wine Making Grapes are the world’s leading fruit crop and the eighth most important food crop in the world, exceeded only by the principal cereals and starchytubers. Though substantial quantities are used for fresh fruit, raisins, juice and preserves, most of the world’s annual production of about 60 million [...] Read more →

AB Bookman’s 1948 Guide to Describing Conditions: As New is self-explanatory. It means that the book is in the state that it should have been in when it left the publisher. This is the equivalent of Mint condition in numismatics. Fine (F or FN) is As New but allowing for the normal effects of [...] Read more →

EIGHTEEN GALLONS is here give as a STANDARD for all the following Recipes, it being the most convenient size cask to Families. See A General Process for Making Wine If, however, only half the quantity of Wine is to be made, it is but to divide the portions of [...] Read more →

A terrestial globe on which the tracts and discoveries are laid down from the accurate observations made by Capts Cook, Furneux, Phipps, published 1782 / globe by John Newton ; cartography by William Palmer, held by the State Library of New South Wales The British Library, using sophisticated filming equipment and software, [...] Read more →

Notes on the intaglio processes of the most expensive book on birds available for sale in the world today. The Audubon prints in “The Birds of America” were all made from copper plates utilizing four of the so called “intaglio” processes, engraving, etching, aquatint, and drypoint. Intaglio [...] Read more →

Citrus Fruit Culture THE PRINCIPAL fruit and nut trees grown commercially in the United States (except figs, tung, and filberts) are grown as varieties or clonal lines propagated on rootstocks. Almost all the rootstocks are grown from seed. The resulting seedlings then are either budded or grafted with propagating wood [...] Read more →

Cleremont Club 44 Berkeley Square, London Home Top of Pg. Read more →

Testing the Irish Blue Terrier Breed in 1923. Home Top of Pg. Read more →

|

From Dr. Marvel’s 1929 book entitled Hoodoo for the Common Man, we find his infamous Hoochie Coochie Hex. What follows is a verbatim transcription of the text: The Hoochie Coochie Hex should not be used in conjunction with any other Hexes. This can lead to [...] Read more →

If a Woman asks you to Change, Politely Excuse Yourself and Walk out the Door; Forever Nobody changes; character is built early in life, and by the time one is involved in adult relationships, it is highly unlikely that one can rebuild one’s character. Recognizing this early on in ones adult [...] Read more →

Home Top of Pg. Read more →

Chipping a Turpentine Tree DISTILLING TURPENTINE One of the Most Important Industries of the State of Georgia Injuring the Magnificent Trees Spirits, Resin, Tar, Pitch, and Crude Turpentine all from the Long Leaved Pine – “Naval Stores” So Called. Dublin, Ga., May 8. – One of the most important industries [...] Read more →

Home Top of Pg. Read more →

Jul. 30, 1898 Forest and Stream Pg. 87 Indian Mode of Hunting. I.—Beaver. Wa-sa-Kejic came over to the post early one October, and said his boy had cut his foot, and that he had no one to steer his canoe on a proposed beaver hunt. Now [...] Read more →

? The Band: Miles Davis (trumpet), Wayne Shorter (sax), Herbie Hancock (piano), Ron Carter (bass), Tony Williams (drums) Home Top of Pg. Read more →

Notes on the intaglio processes of the most expensive book on birds available for sale in the world today. The Audubon prints in “The Birds of America” were all made from copper plates utilizing four of the so called “intaglio” processes, engraving, etching, aquatint, and drypoint. Intaglio [...] Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

How happy is he born and taught. That serveth not another’s will; Whose armour is his honest thought, And simple truth his utmost skill Whose passions not his masters are; Whose soul is still prepared for death, Untied unto the world by care Of public fame or private breath; Who envies none that chance [...] Read more →

Add 3 quarts clover blossoms* to 4 quarts of boiling water removed from heat at point of boil. Let stand for three days. At the end of the third day, drain the juice into another container leaving the blossoms. Add three quarts of fresh water and the peel of one lemon to the blossoms [...] Read more →

The greatest cause of failure in vinegar making is carelessness on the part of the operator. Intelligent separation should be made of the process into its various steps from the beginning to end. PRESSING THE JUICE The apples should be clean and ripe. If not clean, undesirable fermentations [...] Read more →

. Home Top of [...] Read more →

J.P. Morgan Patent #8,452,703 Method and system for processing internet payments using the electronic funds transfer network. Abstract Embodiments of the invention include a method and system for conducting financial transactions over a payment network. The method may include associating a payment address of an account [...] Read more →

TROF. C. F. HOLDFER AND HIS 183LBS. TUNA, WITH BOATMAN JIM GARDNER. July 2, 1898. Forest and Stream Pg. 11 The Tuna Record. Avalon. Santa Catalina Island. Southern California, June 16.—Editor Forest and Stream: Several years ago the writer in articles on the “Game Fishes of the Pacific Slope,” in [...] Read more →

Reprint from The Pitfalls of Speculation by Thomas Gibson 1906 Ed. THE PUBLIC ATTITUDE TOWARD SPECULATION THE public attitude toward speculation is generally hostile. Even those who venture frequently are prone to speak discouragingly of speculative possibilities, and to point warningly to the fact that an overwhelming majority [...] Read more →

John Keats Four Seasons fill the measure of the year; There are four seasons in the mind of man: He has his lusty spring, when fancy clear Takes in all beauty with an easy span; He has his Summer, when luxuriously Spring’s honied cud of youthful thoughts he loves To ruminate, and by such [...] Read more →

Home Top of Pg. Read more →

THE FOWLING PIECE, from the Shooter’s Guide by B. Thomas – 1811. I AM perfectly aware that a large volume might be written on this subject; but, as my intention is to give only such information and instruction as is necessary for the sportsman, I shall forbear introducing any extraneous [...] Read more →

Home Top of Pg. Read more →

Painting the Brooklyn Bridge, Photo by Eugene de Salignac , 1914 Excerpt from: The Preservation of Iron and Steel Structures by F. Cosby-Jones, The Mechanical Engineer January 30, 1914 Painting. This is the method of protection against corrosion that has the most extensive use, owing to the fact that [...] Read more →

Hudson Bay: Trappers, 1892. N’Talking Musquash.’ Fur Trappers Of The Hudson’S Bay Company Talking By A Fire. Engraving After A Drawing By Frederic Remington, 1892. Indian Modes of Hunting. IV.—Musquash. In Canada and the United States, the killing of the little animal known under the several names of [...] Read more →

Home Top of Pg. Read more →

The following are transcripts of two letters written by the Founding Father Thomas Jefferson on the subject of seed saving. “November 27, 1818. Monticello. Thomas Jefferson to Henry E. Watkins, transmitting succory seed and outlining the culture of succory.” [Transcript] Thomas Jefferson Correspondence Collection Collection 89 Read more →

Home Top of Pg. Read more →

THE FIRST step in producing a satisfactory crop of tobacco is to use good seed that is true to type. The grower often can save his own seed to advantage, if he wants to. Before topping is done, he should go over the tobacco field carefully to pick [...] Read more →

Add the following ingredients to a four or six quart crock pot, salt & pepper to taste keeping in mind that salt pork is just that, cover with water and cook on high till it boils, then cut back to low for four or five hours. A slow cooker works well, I [...] Read more →

Citrus Fruit Culture THE PRINCIPAL fruit and nut trees grown commercially in the United States (except figs, tung, and filberts) are grown as varieties or clonal lines propagated on rootstocks. Almost all the rootstocks are grown from seed. The resulting seedlings then are either budded or grafted with propagating wood [...] Read more →

Como dome facade – Pliny the Elder – Photo by Wolfgang Sauber Work in Progress… THE VARNISHES. Every substance may be considered as a varnish, which, when applied to the surface of a solid body, gives it a permanent lustre. Drying oil, thickened by exposure to the sun’s heat or [...] Read more →

From Fores’s Sporting Notes and Sketches, A Quarterly Magazine Descriptive of British, Indian, Colonial, and Foreign Sport with Thirty Two Full Page Illustrations Volume 10 1893, London; Mssrs. Fores Piccadilly W. 1893, All Rights Reserved. GLIMPSES OF THE CHASE, Ireland a Hundred Years Ago. By ‘Triviator.’ FOX-HUNTING has, like Racing, [...] Read more →

The Effect of Magnetic Fields on Wound Healing Experimental Study and Review of the Literature Steven L. Henry, MD, Matthew J. Concannon, MD, and Gloria J. Yee, MD Division of Plastic Surgery, University of Missouri Hospital & Clinics, Columbia, MO Published July 25, 2008 Objective: Magnets [...] Read more →

From Allen’s Indian Mail, December 3rd, 1851 BOMBAY. MUSULMAN FANATICISM. On the evening of November 15th, the little village of Mahim was the scene of a murder, perhaps the most determined which has ever stained the annals of Bombay. Three men were massacred in cold blood, in a house used [...] Read more →

King Arthur, Legends, Myths & Maidens is a massive book of Arthurian legends. This limited edition paperback was just released on Barnes and Noble at a price of $139.00. Although is may seem a bit on the high side, it may prove to be well worth its price as there are only [...] Read more →

Home Top of Pg. Read more →

*note – Billesdon and Billesden have both been used to name the hunt. BILLESDEN COPLOW POEM [From “Reminiscences of the late Thomas Assheton Smith, Esq”] The run celebrated in the following verses took place on the 24th of February, 1800, when Mr. Meynell hunted Leicestershire, and has since been [...] Read more →

Dec. 24, 1898 Forest and Stream Pg. 513-514 The Standard Navy Boats. Above we find, The accompanying illustrations show further details of the standard navy boats, the lines of which appeared last week. In all of these boats, as stated previously, the quality of speed has been given [...] Read more →

Liquorice, the roots of Glycirrhiza Glabra, a perennial plant, a native of the south of Europe, but cultivated to some extent in England, particularly at Mitcham, in Surrey. Its root, which is its only valuable part, is long, fibrous, of a yellow colour, and when fresh, very juicy. [...] Read more →

Take to every quart of water one pound of Malaga raisins, rub and cut the raisins small, and put them to the water, and let them stand ten days, stirring once or twice a day. You may boil the water an hour before you put it to the raisins, and let it [...] Read more →

Crewe Hall Dining Room THE transient tenure that most of us have in our dwellings, and the absorbing nature of the struggle that most of us have to make to win the necessary provisions of life, prevent our encouraging the manufacture of well-wrought furniture. We mean to outgrow [...] Read more →

Carya Nuts This Handbook is Published by SLMA or the Southeastern Lumber Manufacturer’s Association Click here to read the handbook or click on the link below for a faster download. Hardwood Handbook Home Top of Pg. Read more →

EBAY’S FRAUD PROBLEM IS GETTING WORSE EBay has had a problem with fraudulent sellers since its inception back in 1995. Some aspects of the platform have improved with algorithms and automation, but others such as customer service and fraud have gotten worse. Small sellers have definitely been hurt by eBay’s [...] Read more →

If ever it could be said that there is such a thing as miracle healing soil, Ivan Sanderson said it best in his 1965 book entitled Ivan Sanderson’s Book of Great Jungles. Sanderson grew up with a natural inclination towards adventure and learning. He hailed from Scotland but spent much [...] Read more →

From the classic British Movie, The Shooting Party, a 1985 British drama film directed by Alan Bridges based on Isabel Colegate’s 9th novel of the same name published in 1980 we find a scene set in the billiards parlor whereupon the host of the weekend shooting party Sir Randolph Nettleby walks in [...] Read more →

Home Top of Pg. Read more →

San Felipe Model Reprinted from FineModelShips.com with the kind permission of Dr. Michael Czytko The SAN FELIPE is one of the most favoured ships among the ship model builders. The model is elegant, very beautifully designed, and makes a decorative piece of art to be displayed at home or in the [...] Read more →

Home Top of Pg. Read more →

Charles Dickens wrote much more than novels. In fact he turned out several very interesting dictionaries to include one of London, one of Paris and one on London’s long meandering river Thames. Click here to read a copy of the Dictionary of the Thames. Home Top of Pg. Read more →

Reprint from The Sportsman’s Cabinet and Town and Country Magazine, Vol I. Dec. 1832, Pg. 94-95 To the Editor of the Cabinet. SIR, Possessing that anxious feeling so common among shooters on the near approach of the 12th of August, I honestly confess I was not able [...] Read more →

Home Top of Pg. Read more →

Twinings London – photo by Elisa.rolle Is the tea in your cup genuine? The fact is, had one been living in the early 19th Century, one might occasionally encounter a counterfeit cup of tea. Food adulterations to include added poisonings and suspect substitutions were a common problem in Europe at [...] Read more →

Country House Christmas Pudding Ingredients 1 cup Christian Bros Brandy ½ cup Myer’s Dark Rum ½ cup Jim Beam Whiskey 1 cup currants 1 cup sultana raisins 1 cup pitted prunes finely chopped 1 med. apple peeled and grated ½ cup chopped dried apricots ½ cup candied orange peel finely chopped 1 ¼ cup [...] Read more →

ORIGIN OF THE APOTHECARY. The origin of the apothecary in England dates much further back than one would suppose from what your correspondent, “A Barrister-at-Law,” says about it. It is true he speaks only of apothecaries as a distinct branch of the medical profession, but long before Henry VIII’s time [...] Read more →

Click here to visit the New Yorkshire YouTube channel. Home Top of Pg. Read more →

Home Top of Pg. Read more →

THE HATHA YOGA PRADIPIKA Translated into English by PANCHAM SINH Panini Office, Allahabad [1914] INTRODUCTION. There exists at present a good deal of misconception with regard to the practices of the Haṭha Yoga. People easily believe in the stories told by those who themselves [...] Read more →

ON THE ORIGIN OF SPECIES BY MEANS OF NATURAL SELECTION, OR THE PRESERVATION OF FAVOURED RACES IN THE STRUGGLE FOR LIFE. BY CHARLES DARWIN, M.A., FELLOW OF THE ROYAL, GEOLOGICAL, LINNÆAN, ETC., SOCIETIES ; AUTHOR OF ‘JOURNAL OF RESEARCHES DURING H.M.S. BEAGLE’S [...] Read more →

Chen Lin, Water fowl, in Cahill, James. Ge jiang shan se (Hills Beyond a River: Chinese Painting of the Yuan Dynasty, 1279-1368, Taiwan edition). Taipei: Shitou chubanshe fen youxian gongsi, 1994. pl. 4:13, p. 180. Collection of the National Palace Museum, Taipei. scroll, light colors on paper, 35.7 x 47.5 cm Read more →

Mortlake Tapestries at Chatsworth House Click here to learn more about the Mortlake Tapestries of Chatsworth The Mortlake Tapestries were founded by Sir Francis Crane. From the Dictionary of National Biography, 1885-1900, Volume 13 Crane, Francis by William Prideaux Courtney CRANE, Sir FRANCIS (d. [...] Read more →

Biograph Theater, where John Dillinger was gunned down by the FBI on July 22, 1934 The Great Depression was on—highway based crime was rampant, the gangsters dressed as well as the bankers they robbed, and and Henry Ford’s big beautiful V8 sedan was the getaway car of choice for both wheelman and [...] Read more →

The following research discussion is from a study funded by the U.S. National Institute of Health entitled: Boschniakia rossica prevents the carbon tetrachloride-induced hepatotoxicity in rat. It may be of interest to heavy drinkers. Home Top of [...] Read more →

Cannone nel castello di Haut-Koenigsbourg, photo by Gita Colmar Without any preliminary cleaning the bronze object to be treated is hung as cathode into the 2 per cent. caustic soda solution and a low amperage direct current is applied. The object is suspended with soft copper wires and is completely immersed into [...] Read more →

New York Stock Exchange Floor September 26,1963 The Specialist as a member of a stock exchange has two functions.’ He must execute orders which other members of an exchange may leave with him when the current market price is away from the price of the orders. By executing these orders on behalf [...] Read more →

EIGHTEEN GALLONS is here give as a STANDARD for all the following Recipes, it being the most convenient size cask to Families. See A General Process for Making Wine If, however, only half the quantity of Wine is to be made, it is but to divide the portions of [...] Read more →

Toxicity of Rhododendron From Countrysideinfo.co.UK “Potentially toxic chemicals, particularly ‘free’ phenols, and diterpenes, occur in significant quantities in the tissues of plants of Rhododendron species. Diterpenes, known as grayanotoxins, occur in the leaves, flowers and nectar of Rhododendrons. These differ from species to species. Not all species produce them, although Rhododendron ponticum [...] Read more →

A rhetorical question? Genuine concern? In this essay we are examining another form of matter otherwise known as national literary matters, the three most important of which being the Matter of Rome, Matter of France, and the Matter of England. Our focus shall be on the Matter of England or [...] Read more →

Richard Barker KJ Title Pg. Robert Barker was the printer of the first edition of the King James Bible in 1611. He was the printer to King James I and son of Christopher Barker, printer to Queen Victoria I. Home Top of Pg. Read more →

Home Top of Pg. Read more →

The Apex Building, headquarters of the Federal Trade Commission, on Constitution Avenue and 7th Streets in Washington, D.C.. The building was designed by Edward H. Bennett under the purview of Secretary of the Treasury Andrew W. Mellon, and was completed in 1938 at a cost of $125 million. Photo by Carol M. Highsmith [...] Read more →

AB Bookman’s 1948 Guide to Describing Conditions: As New is self-explanatory. It means that the book is in the state that it should have been in when it left the publisher. This is the equivalent of Mint condition in numismatics. Fine (F or FN) is As New but allowing for the normal effects of [...] Read more →

Click here to read the Condon Report Home Top of Pg. Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →